Forensic Audit

A Forensic Audit is an in-depth examination of the financial records of a firm. This audit generally serves the purpose of the legal proceeding by jotting down key points as evidence. A forensic audit is capable of revealing such discrepancies from a company’s financial data.

What needs to invoke the forensic audit?

There are plenty of reasons why Forensic audit investigations are conducted. Below we have mentioned some potential reasons that raise the need for a forensic audit.

Corruption

While conducting a Forensic audit investigation, an auditor would pay attention to the following factors:

Conflicts of interest

It means that when a culprit takes advantage of his/her position for illegal financial profit harmful to the firm. For instance- if a manager authenticates employee’s expenses, which is invalid due to personal relations. Even though this approval won’t benefit the manager directly, he is likely to obtain personal benefits from the employee afterward.

Bribery

As the name suggests, rendering monetary aid to someone to get things done, this in fact cannot be completed via legal means. This illegal financial[1] aid is called a bribe, and the process is known as bribery. For instance, Company ‘A’ official bribing an employee of Company ‘B’ to obtain some secret and high-valued data for the purpose of preparing a tender.

Extortion

Unlike bribery, extortion is straightforward. It is generally used to manipulate someone for gains through threats, either physically or mentally. For example: If Company B discards the contract of Company A and demands money to authenticate the contract. This demand for money, in laymen term is known as extortion.

Asset Misappropriation

Asset Misappropriation is a common form of fraud. Misappropriation of cash, creating invoices that adhere to no authenticity whatsoever, payments made to officials that don’t even exist, assets mismanagement are a few examples of asset misappropriation.

Financial statement fraud

Companies primarily adopt this form of

fraud to avert tax liabilities by falsifying their financial data.

This usually helps them to grab more

money out of generated profit and

provide consistent bonuses to the top

management. Furthermore, this type of

fraud also lures the firm to procure

extra funds to compensate for

foreseeable losses that may invoke in

the future.

Intentional

falsification of financing records,

preparation of faulty transactions –

revenue or expenses, hiding relevant

accounting details, and not complying

with relevant financial norms are the

few examples of financial statement

fraud.

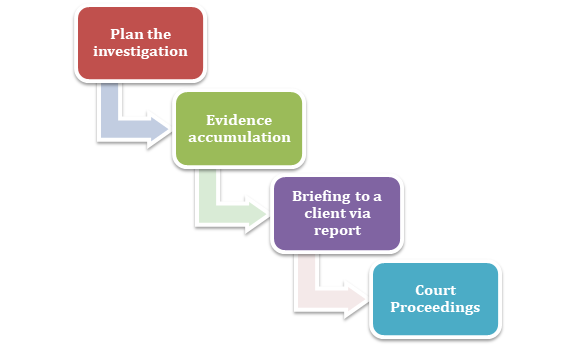

What is Forensic audit investigation procedure?

A forensic auditor is a trained professional with in-depth knowledge of forensic audit techniques and knows every bit of legalities linked with accounting issues. A forensic audit is a comprehensive version of the regular audit and has some additional steps such as.

Plan the investigation

When the client opts for Forensic auditing, the auditor needs to pinpoint the concerned area that needs to be scrutinized. For example, the client fails to acknowledge the type of fraud that is accountable for the poor quality of raw materials supplied. Here, a forensic auditor has to outline their investigation and satisfy the following objectives.

- Identify the category of fraud that is being carried out.

- Identify the time frame in which the fraudulent activities took place.

- Discover how the culprits concealed the fraud.

- Identify the main culprits behind the scam.

- Quantify the monetary loss occurred due to fraud.

- Gather relevant evidence for the court proceedings.

- Suggest measures for the prevention of frauds that may invoke in the future.

Collecting evidence

Once the in-depth auditing is

completed, the forensic auditor must

comprehend the nature of the

fraudulent activity and find out the

culprits who are accountable for it.

The gathered evidence will be potent

enough to identity members involved in

fraudulent activities, reveal every

detail w.r.t fraud scheme, and

pinpoint the financial loss.

A

logical representation of evidence

will help the court comprehend every

detail of the fraud that took place in

the company. Forensic auditors need to

maintain the authenticity of the

collected evidence. Conventional

techniques w.r.t evidence gathering in

a forensic audit includes the

following:

- Substantive techniques – For instance, doing a reconciliation, examination of documents, etc

- Analytical procedures – Get comparative data from different segments.

- Computer-assisted audit techniques – Computer software programs that primarily used to pinpoint disparities in the documents.

- Comprehending internal controls thoroughly and testing them to pinpoint the vulnerable loopholes.

- Interviewing the suspect(s)

Reporting

A report is required to intimate the client about the fraud. The audit reports are comprehensive and divided into multiple sections. The same is true for the forensic audit report. Once the auditor compiled the report in a predefined structure, he/she need to review it and ensure the followings elements present there.

- Findings of the investigation.

- Summary of the evidence.

- A briefing of fraud in terms of source, medium, and impact.

- List of preventive measures that could help eliminate such scams in the future.

Once this requirement is fulfilled, the client can opt for legal proceedings to resolve the matter.

Court Proceedings

The forensic auditor must register their presence during the court proceedings to brief the evidence collected. They can also be used for the identification of fraudsters. Their primary role is to brief the fraudulent activity to the concerned person in the court, in a layman term. This will also include the explanation of supporting evidence as well.

Conclusion

To summarize, a forensic audit seeks accounting expertise and in-depth knowledge of auditing procedures and legal framework. A forensic auditor should be familiar with various categories of frauds and techniques w.r.t evidence gathering.

Office Address

Huda Complex, Rohtak

Haryana-124001.

Phone :+918199990366

Email :info@compliancesolution.in